The technical analysis is one of the most important aid for a successful Forex trade. She gives important explanations about how exchange rates develop in future. Before all private investor these turn the technical analysis preferentially and also for short-term commercial strategies can be used. Thus can profit in particular Daytrader with a rather short-term investment horizon from it. Courses often move with the help of similar patterns which can be identified with a technical analysis. Afterwards from it profitable and gainful Trades can be developed.

Acceptances of the technical analysis:

With the help of the technical analysis can be determined whether the market is in a downward trend, an upward trend or in a Seitwärtsbewegung. Besides, the technical analysis rests mainly on the following acceptances:

- All basic data of the market are reflected in the prize data again.

- The reasons for course movements are clearly less relevant in the technical analysis.

- The Forex market moves in certain cycles what always returning patterns can be derived from. These patterns are also called trends and serve as signals for the development of an investment strategy. Aim in the technical analysis is to be predicted future trends by the investigation of the past trends.

- Price fluctuations never come about by chance, because the acceptance insists that prices on the Forex market move in predictable manner. After the education of a trend this movement will continue for a certain period what becomes evident by the technical analysis.

By the use of technical indicators traders with the right broker are able like ActivTrades to determine the suitable ones an one and climbing out time. Around the technical indicators become to indicate, primarily, volume charts, in course charts as well as gliding averages used. Besides, every indicator serves a certain purpose. Thus trends reveal themselves or the strength and continuity of a trend investigate. An advantage is present that the emotional aspect remains in the technical analysis completely outside before. To investment decisions are met exclusively with the help of the technical charts.

Linienchart

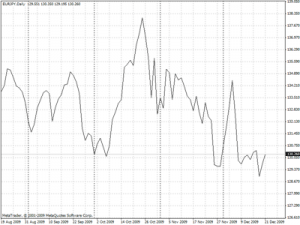

Line charts easier get themselves and are relatively easy to read. Because this representation form is used often also in other areas, it is familiar to most people, besides, already. With the Linienchart all closing prices successive within a certain time span are shown as points and afterwards are connected with a line. With the Forex trade line charts are provided for different periods of one week, one day, one hour or even one minute.

Line charts easier get themselves and are relatively easy to read. Because this representation form is used often also in other areas, it is familiar to most people, besides, already. With the Linienchart all closing prices successive within a certain time span are shown as points and afterwards are connected with a line. With the Forex trade line charts are provided for different periods of one week, one day, one hour or even one minute.Balkenchart

Beam charts are more specific around something and to read a little more complicated. They consist of a vertical beam and two waagrechten lines. In this manner the opening rate, the closing price as well as the deepest and highest traded exchange rate is shown. Besides, under point shows Most deeply and the upper point the highest level within the respective period. At the same time the left waagrechte line shows the opening rate and the right waagrechte line the closing price. Therefore points of the Balkenchart the complete trade profit margin of a currency pair for a certain period.

Beam charts are more specific around something and to read a little more complicated. They consist of a vertical beam and two waagrechten lines. In this manner the opening rate, the closing price as well as the deepest and highest traded exchange rate is shown. Besides, under point shows Most deeply and the upper point the highest level within the respective period. At the same time the left waagrechte line shows the opening rate and the right waagrechte line the closing price. Therefore points of the Balkenchart the complete trade profit margin of a currency pair for a certain period.

Beam charts are called very often also "OHLC" charts. Besides, "Open" stands for the opening rate, "High" for the Höchstkurs, "Low" for the Tiefstkurs and "Close" for the closing price.

Beam charts are generated in practice for periods of one minute up to one month. Besides, investors speak of "Timeframes" which are measured during minutes, hours, days or months.

Candlestick charts (candle charts)

Candle charts differ with regard to her explanatory power not from beam charts. There are differences merely what the graphic form concerns and candle charts are felt mostly as optically more successful. In addition they offer the advantage that trend changes can be shown substantially more unambiguously.

Candle charts differ with regard to her explanatory power not from beam charts. There are differences merely what the graphic form concerns and candle charts are felt mostly as optically more successful. In addition they offer the advantage that trend changes can be shown substantially more unambiguously.

Instead of the vertical beam with two waagrechten steps candle charts own a vertical "body" and two waagrechte "shadows". Of it one is about and one under the body. With the help of the body the span reveals itself between opening rate and closing price. The Shadows stand for Highly and the Tiefstkurs.

Different colours of the Forex charts

To be able to read become the charts better this on modern Tradingplattformen in different colours shown. The colour is directed afterwards whether at them with a higher state close or reverse. With black beams gainful periods are shown loss-bringing and with white beams. In some main entrances the colours are used instead of black and white also red and green.

A black or red candle registers that the closing price lay under the opening rate. With a white or green candle this has turned back. Should the left beam line lie under the right one and be red the whole beam black or the opening rate is higher than the closing price.

BASIC ANALYSIS VERSUS TECHNICAL ANALYSIS

For many brokers it is a religious question. While only one trust in the present datum, place other exclusively on the explanatory power of the charts. We take both analysis methods under the magnifying glass and look in part 1 first at the advantages and disadvantages of the technical analysis.

Only it was the US dollar, then DAX, and now still gold. Quite several times impressive course movements were begun this year, after a value had crossed or fell short of an important charttechnische brand. With the help of the technical analysis these outbreak brands which cause a stronger course movement with achievement with high likelyhood can be defined. The currency pair hears US dollar / Japanese yen to the best examples this year. Between February and August of this year the US dollar tended in a narrow rank between 101 and 104 yens sidelong, although already in this phase the basic basic conditions of both currencies had clearly changed. Only an outbreak from this Seitwärtsbewegung in August rang in a massive revaluation of the US dollar which could increase afterwards within less weeks on about 115 yens.

Advantages of the technical analysis

Job of the technical analysis is to define favorable entrance and climbing out signals. Besides, she fades out economic figures or economical data completely and tries to estimate on the basis of historical course patterns and on the basis of indicators the future chart development. Technical analysts look with it solely at the respective course movements and not possibly

on the reasons which lead to these changes. This approach brings a huge saving of time with itself, technically oriented traders must thin out, nevertheless, no enterprise balances or interpret enterprise news. In addition, the technical analysis compared with the basic analysis needs by far less data, already mostly only very hard and incompletely to

are received. All required information for the technical analysis can be read from the price and volume. The necessary knowledge, suitable tools like commercial software as well as a computer presumed, offers the technical analysis good conditions to be able to operate successfully in the market.

on the reasons which lead to these changes. This approach brings a huge saving of time with itself, technically oriented traders must thin out, nevertheless, no enterprise balances or interpret enterprise news. In addition, the technical analysis compared with the basic analysis needs by far less data, already mostly only very hard and incompletely to

are received. All required information for the technical analysis can be read from the price and volume. The necessary knowledge, suitable tools like commercial software as well as a computer presumed, offers the technical analysis good conditions to be able to operate successfully in the market.

Borders of the technical analysis

Technical analyses not always run successfully, historical course patterns can be transferred in the future. The return of certain course courses is booked till this day academically. The technical analysis bumps in particular into view of a longer period to her borders, rises here, nevertheless, the danger of the external influence which demonstrates the preceding analysis worthless. The use of information which is exclusively past-oriented is the most frequent point of criticism of the opponents of the technical analysis.

489271

489271