Without sensible strategy just the action with foreign currency is mostly successful only by chance. The best currency traders use as a rule at least one or several methods to generate permanently profits. One of these methods is the Fibonacci strategy. With her help trends can become and the optimum time for opening and closing a position be investigated.

1. What are Fibonacci figures?

Fibonacci figures are already known since the antiquity, nevertheless, were called by as the most important mathematician of the Middle Ages, Leonardo there Pisa, Fibonacci, popularly. He described at the beginning of the 13th century with the numerical order the growth of a rabbit population and called them once more in the consciousness of the people. How much meaning is in this absolutely mythical-charged sequence, is still unclear. Nevertheless, fact is that it can be often found again in the nature and also is applicable on market prices.

2. How Fibonacci figures determined?

The inquiry of Fibonacci figures is lighter than it may look at first sight. For the inquiry of the result are given for both first figures the value one. Afterwards two neighbouring figures are always added up.

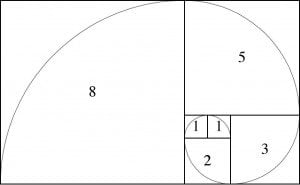

The result is 1, 1, 2 (1+1), 3 (1+2), 5 (2 + 3), 8 (3 + 5), etc.

Besides, the quotients of two successive Fibonacci figures get closer, by the way, to the golden cut always. This is also relevant for the calculation of the most important figures for the Traden.

Since for the Fibonacci-Trading the relations of the figures are by far more interesting together. They are also called Fibonacci level. Relevant for the Trading with Fibonacci figures are above all the levels 0; 38.2%; 50%; 62.8% and 1. In isolated cases 23.6% and 76.4% can be also important.

They arise from the division of two successive figures. As already it is mentioned here sensibly to choose bigger figures the calculation, because the quotient approaches then to the optimum value.

If the Fibonacci number 144 is divided by her direct neighbour 89, arises rounded up 1,618. 89 partly by 144 proves 0,618 again. If 89 is divided by 233 what her next but one neighbour is after 144, arises 0,382.

These relations are used with the foreign exchange to be able to estimate movements.

Interestingly these figures agree by chance with the Gann figures which the successful trader used also constantly for his Chart analyses. Because Fibonacci level to most traders are known, it is usual just with currency trade that the Fibonacci strategy also proves to be true because many traders place as it were „on the same horse“.

3. Bases for the Traden with Fibonacci figures

There lies the acceptance that the magnitude of a market movement is also dependent on the strength of the preceding movement. The reactions which stop in certain points (at times) are to be found with movements of a security or index strikingly often. These points are found in so-called opposition or Retracement lines.

If the platform of a Forex broker is able to mark Fibonacci-Retracements, this happens more than three horizontal trend lines which just indicate these opposition lines.

4. Fibonacci signals recognise

Fibonacci signals are relatively easy to recognise, nevertheless, should never be pulled up as the only criterion for the decision of a Trades. It is substantially more sensibly to look in the area around the 50th and 61st line for promising entrance signals. This can be, for example, Candlestick formations like return sticks or Morningstar. Besides, as a rule of thumb is valid basically that positions are opened with the 50th Retracement line, and are closed with 38-%-Retracement again.

Also for the easy use with trend lines the Fibonacci strategy is suitable. Then she brags, for example, with an upward trend, when the right time has come to the entrance.

Above all Retracement lines are ordinarily used to find the right time for the entrance. With Fibonacci Extensions it is worked therefore particularly when it is about Short positions.

Basically are valid as a Retracementslevel: 0.236, 0.382, 0,500, 0.618, 0.764, while they

Pay 0, 0.382, 0.618, 1.000, 1.382, 1.618 to the extension levels are assigned.

Important tip: Fibonacci lines should be better seen than areas then as lines. Reason for the fact is that a big number provides in traders for the fact that the predictions with Fibonacci come true. Indeed, everybody does not use the same references. Above all the commitment the starting point and final point of the course maxima can vary. Besides, therefore inaccuracies and different definitions the level which are similar, besides, still clearly arise. Exceptions are officially announced Pivot points.

5. Stop Loss with Fibonacci place

Just the putting of a Stopp-Loss is astonishingly easy with the Fibonacci strategy.

– If an upward trend exists and a Long position is held, is a possibility to put the Stopp-Loss briefly under the last low-pressure area.

– Besides, the limit should be never put directly on the Retracement lines. Otherwise the closing of the position is released, although the chances stand very good that the course moves afterwards in the opposite direction.

– If a position is traded in the downward trend short, the usual action is by analogy with the upward trend. Here the limit should be briefly put about the last high-level point, because this one new opposition line could register.

Nevertheless, with the putting of these limits should be considered that, besides, the risk is mostly substantially higher than with other procedures. So these limits should be considered only if traders have recognised unequivocal patterns. The security by other analysis technologies should never be also neglected that's why. Moreover, it recommends to work the way up of course also here with dragged Stop-Loss.

6. Mistakes avoid with the Fibonacci-Trading

Fibonacci figures are easy with the Trading to use. They are so popular that most Forex brokers allow the Chart analysis with Fibonacci figures and, besides, the bases are easy to understand. Already beginners learn to recognise fast, Retreatments and extensions. Still there is mistake which are made almost by every trader with the contact with Fibonacci figures and which are to be avoided easily.

1. Authoritative points mix

Authoritative points must distinguish themselves necessarily by consistency to be able to deliver a sensible result. If the authoritative point was so chosen, for example that he shows the lowest value of a trend within a candle body, then he must also remain there and be compared only by suitable dimensions. As soon as the authoritative points are mixed, wrong analyses and failures are the consequence. Candle bodies may be compared exclusively to candle bodies, highs and low-pressure areas also last only with each other in respect should be put.

Who pays attention to it, provides for the fact that the important auxiliary lines are marked perfectly and thus a quick and more reliable analysis becomes possible.

2. Long time trends never ignore

Even if the Fibonacci strategy on brief trends can be applied often successfully, besides, traders should never neglect long time trends. The analysis of the market movement for a longer period enables to recognise opportunities better and to be able to estimate the dynamism of the movement more reliably.

Who observes the long time trend, many mistakes can handle in the Vorhinein. Not seldom it is in such a way that for a short period after Fibonacci an excellent possibility seems to come up. Then in the long time trend becomes clear that this possibility is rather a "trap". With the action with Fibonacci figures is unconditional to pay attention to the consistency of long time trends and short-term development. Only if the analyses of both periods with the prediction of the market movement agree, should be also traded.

3. Use Fibonacci as the only reference

Fibonacci is a wonderful possibility to track down trends. Indeed, this method is also not infallible and cannot deliver, in the end, significantly better results than other Chartanalyse strategies. So it is indispensable to secure Fibonacci with other analysis possibilities.

As sensible supplements to the Fibonacci strategy are suited, for example, of the Stochastic Oscillator and MACD. Together they prove a substantially more reliable picture and raise the likelyhood to recognise good opportunities and to be able to be of use. Luck and chance play thus a substantially less strong role and wrong decisions become rarer.

4. None analyses to short periods with Fibonacci

Fibonacci becomes ineffective if the periods are chosen too briefly. Just with the Daytrading Volatilität plays a too big role, as that with Fibonacci strategies reliable statements can be met. The shorter the analysed period is, the more unreliable becomes the Fibonacci analysis.

With many charts this already, nevertheless, becomes quickly evident. Then the auxiliary lines show no clear picture and it is almost impossible to recognise a suitable time to the entrance. However, even if this is the case, traders should not be deceived. Rashes and Whipsaws are very frequent here and not foresee. To apply Fibonacci figures here is synonymous to follow no strategy and to order simply hit or miss.

Who follows these tips, will see quick how his use of the Fibonacci strategy becomes more successful. Who has applied the tactics up to now unsuccessfully, could have made the following mistakes:

– Inaccuracies with the strategy too few attention given

As already said, Fibonacci functions often because many traders use this strategy without choosing always the same authoritative point. It is advisable, in any case to see the lines as a coarse recommendation and not as absolute values.

– Blurred signals

To discover reliable signals, it is necessary to check them with other methods. Who is not sure, his risk about low position dimensions should minimise.

986482

986482